Another niche OFS name, and other updates

Dear Reader,

You will likely pass over the idea below regardless of how the numbers look or what I say. I know this because I’ve been pitching people niche OFS names for over a year and pretty much the only reciprocal interest has been from veteran oil patch investor David Locke regarding NGS 0.00%↑ , which he already owned. And even when I try to pitch him other OFS names, he’s pretty apathetic. Meanwhile, I keep making money on these ideas despite OIH 0.00%↑ being down 11.8% YTD.

So it doesn’t surprise me too much when I see a niche OFS name trading stupidly cheap, and I’ve learnt to take action rather than waste time pontificating. Such is the case recently with PFIE 0.00%↑, which pretty much fits my template perfectly:

A sharp selloff to a key support level, very likely caused by one panicked / forced seller

Possible escape hatch / diversification from energy as ex-energy segment grows

Absurdly strong balance sheet with 18.5% net cash, a similar net accounts receivable, and even more inventory

Trading at 7.8x trailing earnings

Share count drifting lower

Listen, I’m just going to end the pitch here because, personally, that’s all I needed to know to buy. Knowing that no one else gives a damn to even take a look makes this a lot easier.

Other Updates

MCS 0.00%↑ — Scalpavelli did get a quick scalp in here on the way up, but it was modest. I missed most of it. I should have been more bullish going into the Republican convention, but I’m neutral again here. I feel like hotels in general are just way too expensive and might start weighing on performance even if movie theater operations improve.

$YAMCY — I basically just got really lucky here as I had sold to buy other things (diversification-rebalance) before the crash. Then I bought a full position near the bottom and recently sold. One of my best trades of the year.

YELP 0.00%↑ — I just keep getting more bullish. I will change my mind if we stop making more money every year…

PNRG 0.00%↑ — I sold out this last week as oil plunged below $70. That might have been a mistake. I need to look at the numbers at $65, $70 oil.

Inflation

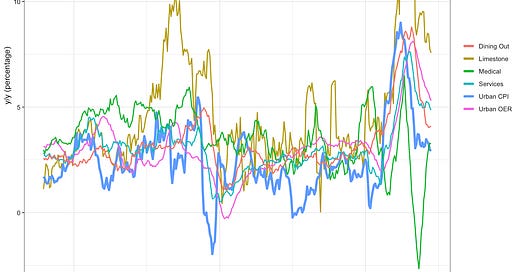

Dining out and services are looking pretty stubborn, but services are now (barely) under 5%. This puts us in a very dangerous territory where the labor market could be weakening but services inflation remains sticky. A white collar recession — I’m not sure if that’s even in the Fed’s playbook.