Dear Readers,

I currently lack the resources to continue research on the LTS (Lindy Trading System). In the meanwhile, I’ve cleaned up some of my monthly macro charts, which I’m sharing so that we can all take a look for ourselves at how things are going.

SIR (Select Inflationary Readings):

After a historic surge in the Urban CPI, it remains stubbornly above 3%. Dining out is still above 5% as services bobbled back up to 5%. I suspect that services inflation is a major source of anxiety at the Fed.

Regional Inflation:

It seems that the regions hit hardest by the inflationary spike are also experiencing the most persistent inflation.

Moody’s BAA:

Confidence in a soft landing is reflected in the BAA-20YT spread collapsing to pre-GFC levels. If we look at the green line we see that real pre-tax yields almost hit the 2016 peak, but post-tax yields have not recovered proportionally because breakevens are up roughly 100 bps; in other words, the government is expected to capture more of the real returns. The BAA index is priced for high net worth / tax-rate investors to return about 1% annualized, post-tax.

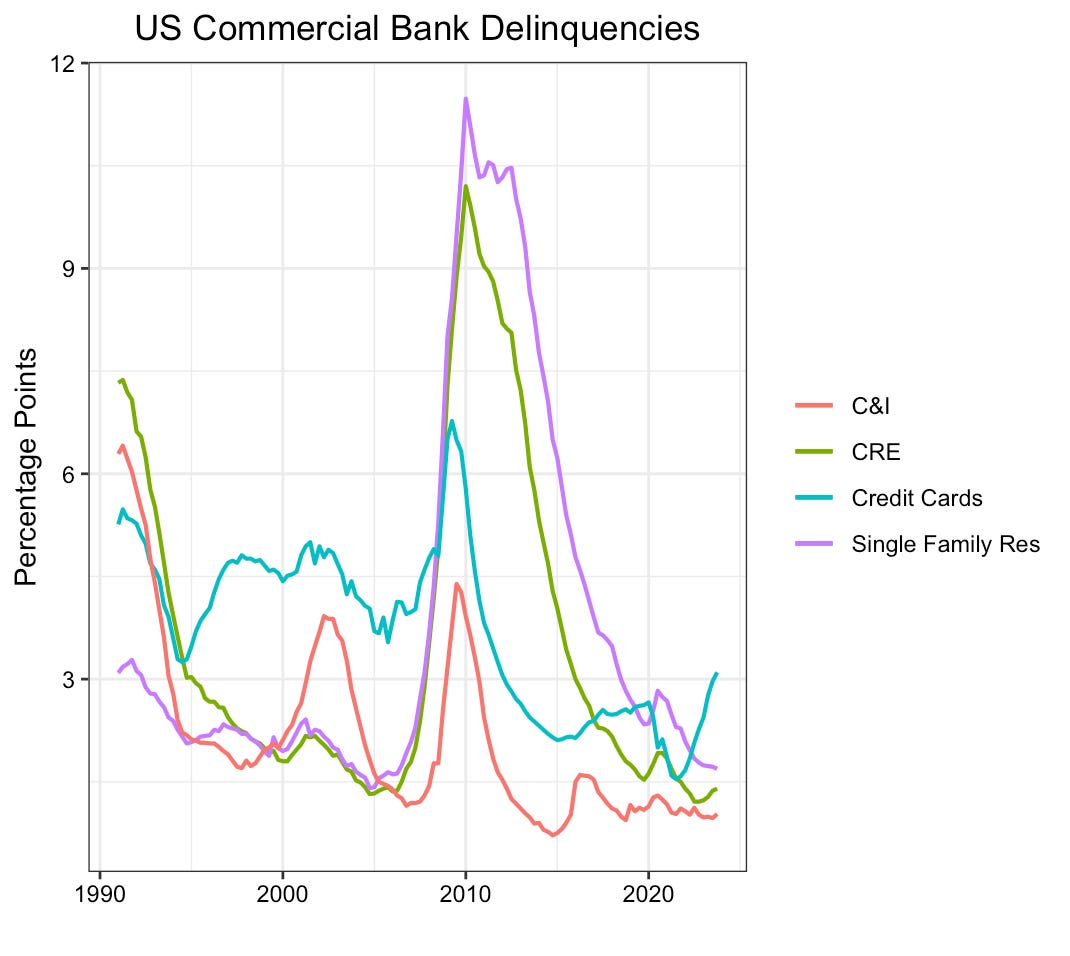

Commercial DQ’s:

Consumers without home equity to draw on are under increasing stress, especially with credit card rates at new highs. Commercial banks continue to play nice with each other and their clients.

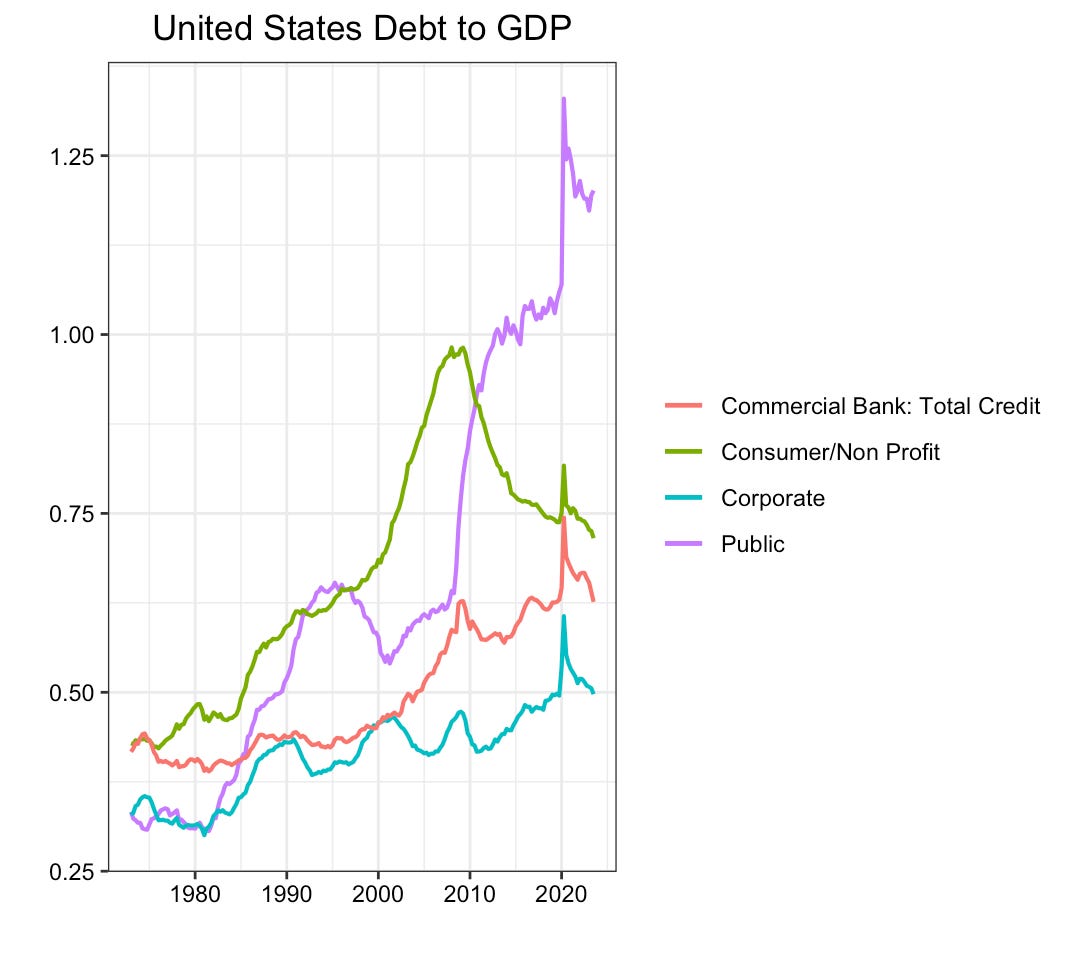

Debt:

The government bailed everyone out, transferring an incredible amount of private sector debt to its balance sheet; resultantly, the typical consumer has a lot of room to leverage up while the most vulnerable are floating by on expensive credit.

Fiscal:

What surprises me most about this chart is that for all the talk of government largesse, expenditures have scarcely outpaced GDP over the last several decades. To me this suggests that there is still plenty of room for the government to expand further via further impulse. If the government spending is productive in itself or productivity has otherwise increased then the impulse should “jump-start” the economy with sustaining benefits; otherwise, it should function more like a “sugar-high” benefit to GDP that fades over 2-3 years, subsequently requiring further impulse (and makes future comps harder). With total commercial bank decelerating, I lean towards the view that the economy will slow down without positive impulse; interestingly, the last few months can be described as treading water at what could be a “fauxldilocks” fakeout: a sugar-high within a broader slowdown.