Campbell's is executing well on Scalpavelli's turnaround game plan

Sitting on the long-term support trend-line, I am a buyer

Howdy folks,

Those of you who follow me on Twitter are aware that I’ve been an extreme critic of Campbell’s management for a couple years now. This is a stock that I have wanted to invest in due to its assortment of lindy, S-tier brands. To name a few: Goldfish, Milano, Rao’s, Snyder’s, Lance, Cape Cod, Kettle, V8, and Campbell’s itself. Wow. If you don’t understand how elite these brands are, I suggest taking Scalpavelli’s word for it.

Problem is, Campbell’s has been bogged down by some dogshit-tier brands and turbo-cringe initiatives from management. Take this classic 2023 slide for example. It alone was terrible enough to convince me to avoid the stock due to my “terrible managers have terrible investor decks” theory:

“Win in Soup 2.0”. Great idea, geniuses. I take it that “Win in Soup 1.0” wasn’t a huge success, huh? Don’t let that stop you from trying again, though.

Fortunately, the Campbell’s family has decided to move on from this nonsense. It all started with the acquisition of Sovos (Rao’s), a truly elite brand with plenty of growth runway purchased at a reasonable price and opportunistically-financed with long-term bonds. It seems that the family liked this move so much that they have replaced the former CEO (edit: I forgot that the former CEO actually left voluntarily to join a football team) with the former President of Food & Beverage who led the deal. He joined the company as CFO in 2019, so I am thinking that he knows what the street wants to see and has a business vision of his own, which is extremely rare in my experience. In turn, they have also promoted the former general manager of the Rao’s brand — who oversaw Rao’s stratospheric rise for six years — to President of Food & Beverage.

I am extremely bullish on these management changes, and the Sovos acquisition in particular.

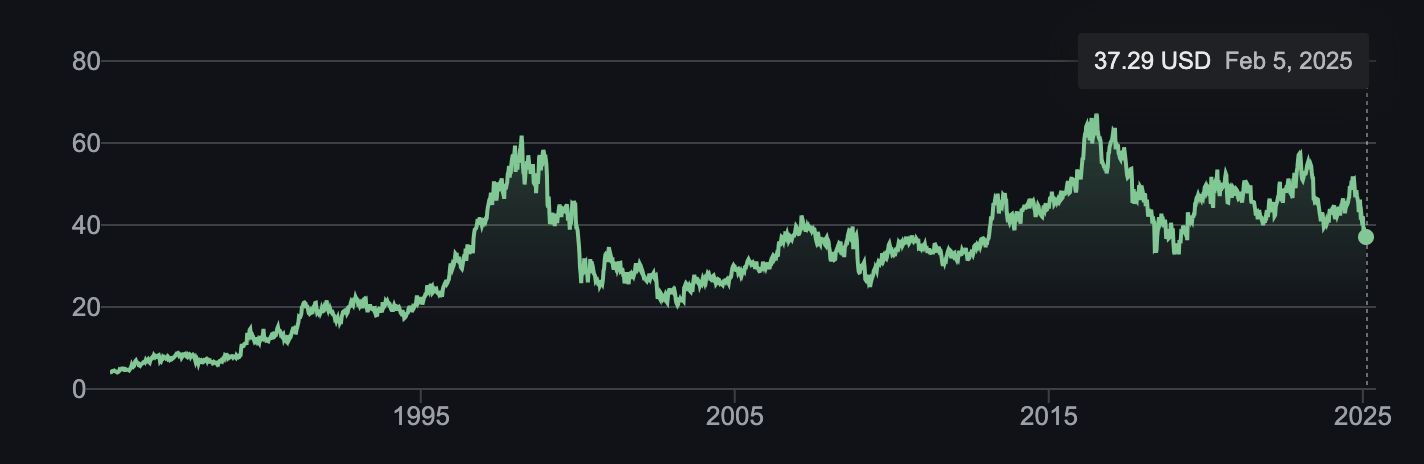

Even better, the market has skittishly priced this as a “show me” story. The divergence between Scalpavelli’s outlook and the market’s is drastic as the stock now sits on a 40-year support trend-line (use your own crayons):

With a trailing P/E of 33.5 as a result of over $400mm of one-off expenses and non-cash writedowns, the stock is optically expensive and few are willing to take a leap of faith. Meanwhile, the company is trading a CY2025 street consensus of 11.3x GAAP EPS.

The market has priced this as a “show me” story. Scalpavelli, on the other hand, has seen enough already and now owns a 2%+ position.

Scalpavelli’s secret technical weapon

I do have a bit of a trick up my sleeve here: the Lindy Trading System. I deleted the primer posts on this system, but the gist of it is that certain ultra-boring stocks seem to have a strong mean-reversion relationships with street analyst price targets. In this case, the critical breach that’s occurred is Campbell’s trading below the lowest analyst price target: $40. I have reason to believe that this is an excellent buy signal. Do your own research.

Risks:

Health trends unfortunately threaten one of the greatest brands of all time, Goldfish, due to its usage of seed oils.

Rao’s has been consistently discounted at my local grocer, perhaps the consumer has been hurting and margins will give.

Thus concludes this micropitch. I hope you’ve enjoyed it. Please subscribe and consider sharing this blog with others.

Note: Trailing P/E is more like low 20's on most platforms. Not sure why Google was showing such a high multiple.