Limestone barons shall inherit the Earth

The geopolitically-strategic super-resource no one is talking about

Dear Reader,

A few years back I was randomly researching the limestone market when I came across a shocking discovery:

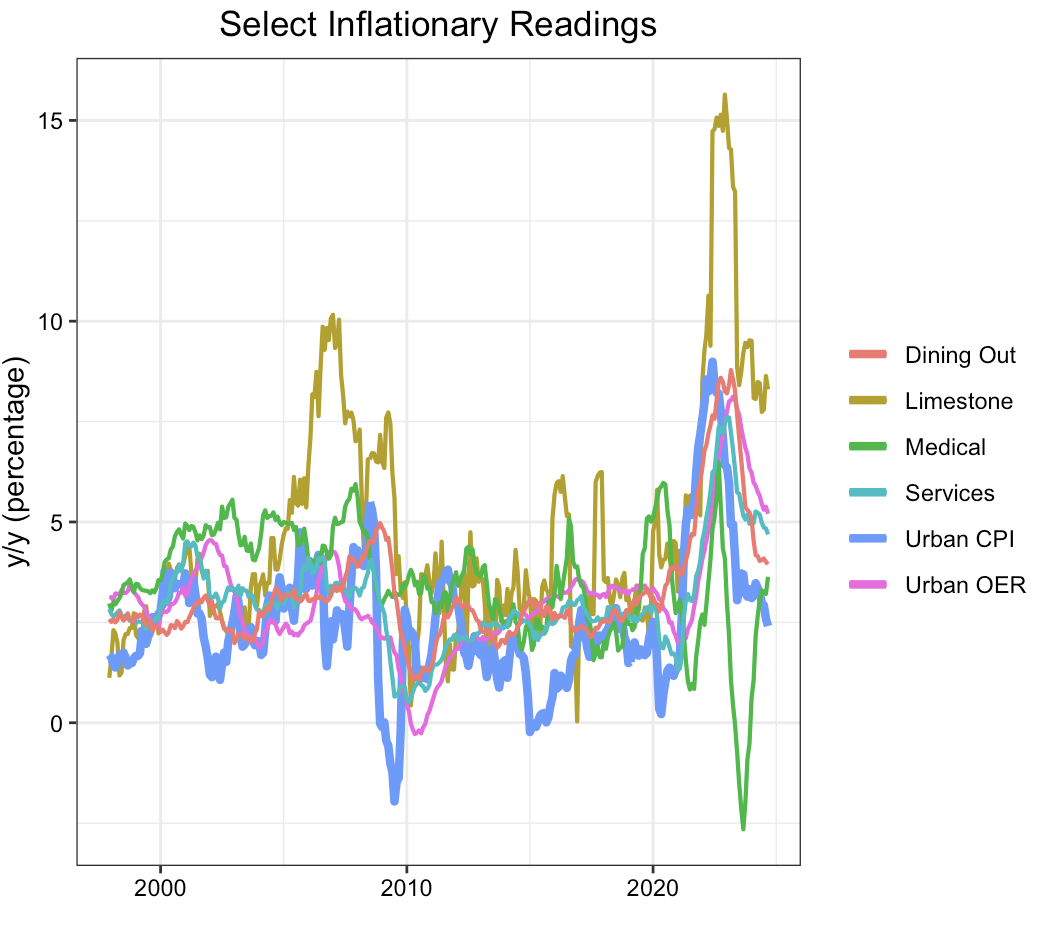

The price of crushed limestone has basically never gone down.

Have ye e’er seen such a thing?

Furthermore, limestone has consistently outperformed broad measures of inflation:

Why / how is this possible?

Industry structure / consolidation: Pure construction aggregates plays in the United States are oligopolistic, especially when broken down regionally. Just moving this stuff around is expensive. Meanwhile, the larger cement conglomerates typically only source about 70%-80% of their own limestone/aggregates. This puts the aggregates pure-plays in an excellent position to triangulate negotiation between the cement companies, other industrial demand, and smaller operators who lack scale.

Asset scarcity / economies of scale: There is a lot of limestone around, but the geology of large, economically-viable quarries is fairly scarce.

Technology: Although a bulk of demand is construction-related, limestone/lime are employed across every major industrial sector, enabling its value to scale alongside broad technological advancement. For example, as an input cost for steel it’s still relatively insignificant — I estimated it a while back as well under one percent of final production cost. As an input to cement, it’s generally around 30%-40% of the raw material cost.

Operator economics / barriers to entry: A top-tier limestone quarry will keep producing for another 50+ years — 100 is not unheard of — which is fantastic news for resource investors whose biggest headwind is addressing (a lack of) terminal value. Limestone investors, on the other hand, welcome the distant future.

Missed Opportunity

Naturally, I looked for ways to make money. And I did find such a name, USLM 0.00%↑ — a pure-play. I tweeted about it at roughly 15x trailing earnings, $25 post-split share price in October 2022.

My research partner bought some. A few of my followers bought some. However, at the I lacked confidence in my skill to value this security as a true long-term investor. Scalpavelli was scared to buy the breakout / overpay for a “cyclical" stock and missed a 5-bagger.

In the investing industry, the above is what we call a “learning opportunity”. So let’s go back in time with the skills that we have now: we’ve just learnt about limestone and we need to put a floor on USLM 0.00%↑ valuation.

Here is my proposal: I expect long term inflation of 3% and limestone to outpace that by 2% with producers getting 20% operating leverage from industry dynamics… therefore I under-write to 50 years of cash flows, 6% growth, 10% discount rate, giving no credit for bolt-on acquisitions or net cash. The resulting multiple is 21.1. That assumes you’re paying a mid-cycle multiple, but I think this is a reasonable rule of thumb — 20x earnings for quality limestone assets.

Current Opportunities / Expert Interview

Okay, I’ll cut to the chase. Recently an expert in European building materials reached out to me to discuss some names and break down the industry. Here’s a brief breakdown of what we’ve discussed, structured/paraphrased as an interview. I own Sigmaroc, Nacco, and GCC, and will likely buy Heidelberg as well:

EBM expert: There are some pretty interesting opportunities at the present moment.

Scalpavelli: Pray tell…

EBM expert: Sigmaroc, $SRC.L, an industry consolidator in Europe. It’s on the AIM. They have done a transformational deal with CRH 0.00%↑ at 4-5x EBITDA as CRH focuses on higher priorities. This roughly doubles their EBITDA and is a significant step towards the industry consolidating towards a structure more similar to that in the United States. Management has a credible plan to create substantial genuine synergies as they integrate CRH assets. Management expects a long tail of smaller operators who will be forced to sell due to lack of scale / efficiency.

Scalpavelli: Alright, well this seems pretty awesome. Seems like the main risks here, other than being too early, are management incentives / future bad deals and Europe(an) regulation. But it looks like we’re getting to 10%+ FCFe yield in the short term with manageable debt, so I’m in.

EBM expert: There’s also $GCC.MX, a cement producer. Most of this company’s operations / income are in the United States but it just sold off with the rest of Mexico. They operate with net cash and their management has prioritized securing 100% self-sufficiency with regard to long-term limestone / aggregate reserves.

Scalpavelli: Wow. This is super cheap compared to $MCEM. The limestone reserves will be a huge advantage for them moving forward versus other players who need to source that marginal 20%+. I’m in. By the way, how do the bigger cement players break down?

EBM expert: I think Heidelberg is the way to go. They have generally done a better job of prioritizing / securing their limestone and their US operations have been improving. Good valuation and quality business that can keep running to catch up to peer multiples.

Scalpavelli: I see they’ve also received substantial free government money / green scam loans. I like the international diversification. Alright, so I’ve got one for you, too.

EBM expert: Go on…

Scalpavelli: NC 0.00%↑ , which I’ve followed for a while, recently announced renewed contracts in their mining division, which focuses on limestone. Several top 10 aggregates producers employ them as mining specialists. It seems that these new contracts have reset margins higher. Lots of other interesting stuff going on with this business at the moment, too, but mining sure seems like an interesting angle.

Very interesting post, thanks for sharing.

I am thrown off by your first comment though. Doesnt that chart show limestone having tons of downturns/declines?