The Marcus Corporation is fairly priced in the absence of a bullish box office outlook

Protracted pain in the box office creates opportunity -- maybe?

The Marcus Corporation — MCS 0.00%↑ — is a “quite fucked to not quite as fucked” investment thesis. Though I own a position, I am far less confident after researching industry trends as a result of doing this writeup and may sell soon in favor of other opportunities. Though I assumed that sentiment was sufficiently blown out and that the box office was lindy, the data is pretty damning — it’s not enough to be contrarian, you also have to be right.

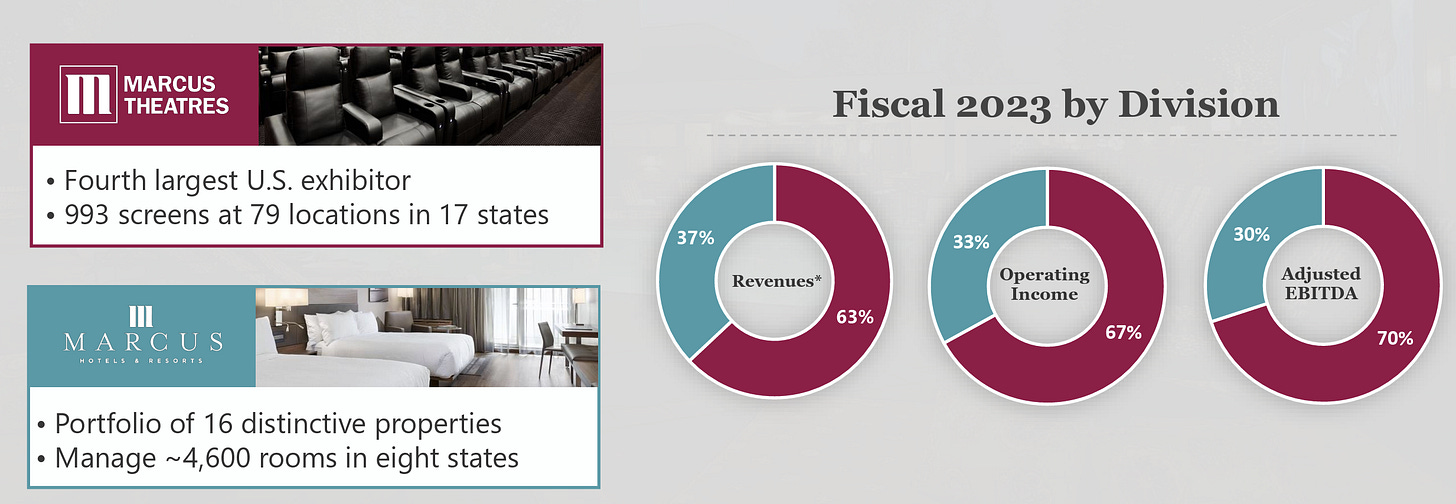

The box office has moved past COVID and the writers / actors strikes of 2023, a flurry of various crew contract negotiations are around the corner with many expiring on July 31st. Furthermore, tensions over AI have complicated industry relations. Combine that with the secular trend of streaming at home and it’s no wonder that investors can scarcely be bothered to take a look at $MCS, the 4th largest U.S. box office exhibitor, owner of several hotels / resorts, and manager of other hotel/resort properties:

Down ~60% since pre-COVID despite minimal dilution and significant deleveraging, MCS 0.00%↑ is approaching its tangible book value of $12.27 per share. Contrast this with $NCLH, whose price is down ~70% while both debt and share count have roughly doubled. Are industry prospects really so relatively grim? Well, let’s just say I’ve put the risks first here for a reason:

Risks

The box office “never” recovers due to changing consumer preferences and lack of affordability, and the pandemic accelerated these secular dynamics

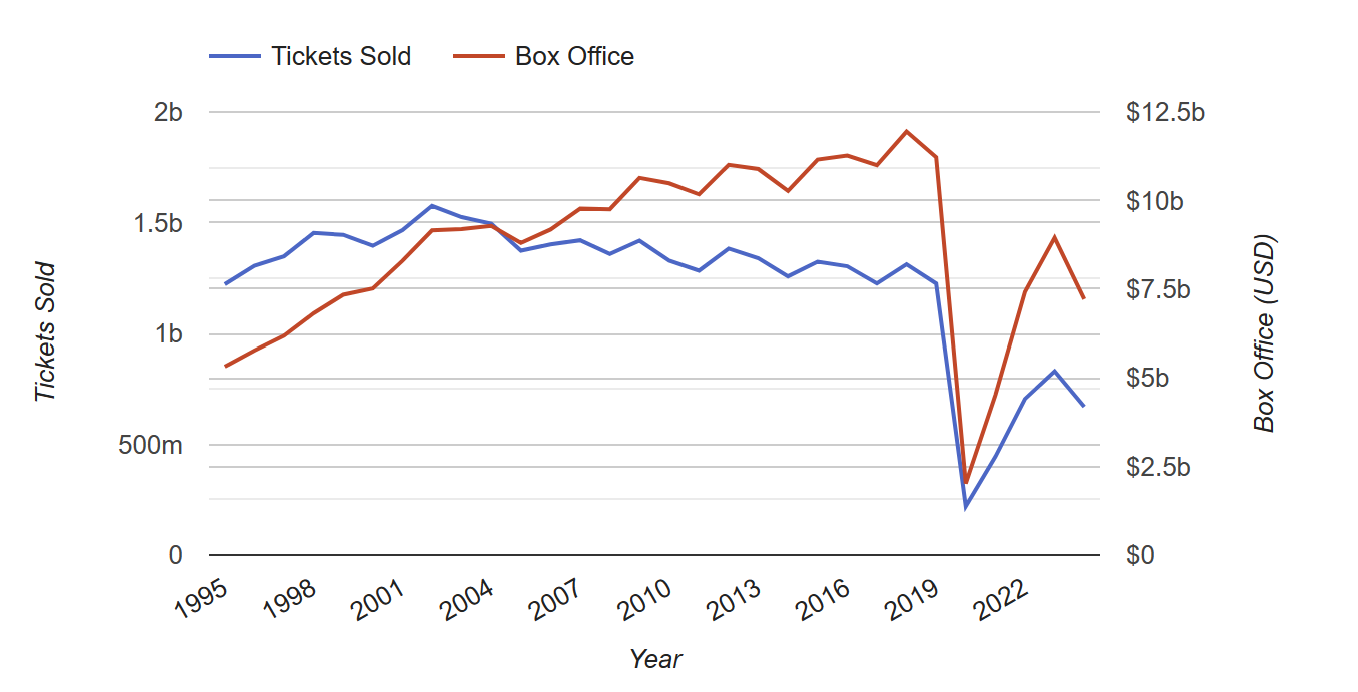

Industry website The-Numbers currently projects (inflation-adjusted) 2024 box office revenue of $7.2bb vs $8.9bb in 2023 (Super Mario Bros, Boppenheimer), $7.6bb in 2022, and $13.2bb in 2019. This is so terrible as to suggest that this year’s weak box office slate is only part of the issue (i.e., there’s more going on than just a slow recovery with regard to the pandemic). As a spot check, we can see that Kung Fu Panda 4 is behind the (inflation-adjusted) sales curve of Kung Fu Panda 2 (2011) by 21% and roughly on par with Kung Fu Panda 3 (2016) — and I would argue it is currently benefiting from a lack of competition. As another spot check, according to The-Numbers, Godzilla vs Kong is currently underperforming their projections.

These numbers are bad. Box office bulls need to argue that an improving slate will re-energize theatergoers who simply “lost momentum” over the pandemic, but that’s not an easy case to make when online streaming has clearly been chipping away at attendance since well before COVID. If the two movies above can’t energize potential viewers to attend the box office, I’m pretty doubtful.

Further compounding this risk is that the industry is clearly over-built. Although domestic competitors are all high-indebted and industry right-sizing / consolidation may be a future opportunity, I think it’s way too early to make that call and “getting a larger piece of a shrinking pie” is rarely a great investment thesis. The most compelling mitigation here is probably that food & beverage sales have offset the decline in ticket sales. This could further be explained by synergies between the hospitality and theater businesses — MCS 0.00%↑ theaters may be more resilient than the industry standard.

Lack of clear catalyst suggests a high probability of a goodco / badco water-treading situation

At 30% of 2023 adjusted EBITDA, the hotel business might mitigate box office downside, but only just enough to keep operating results treading water. Management’s recent acquisition of a JV stake in Loew’s hotel is consistent with a desire to further diversify hotel revenue as a result of a lack of confidence in the box office recovery. The most realistic hope we have for a catalyst is simply the historical dividend rate being reinstated, but the higher rate environment is likely to dampen any excitement surrounding that.

Hospitality segment deteriorates

With hotels pulling more weight relative to pre-pandemic, their deterioration could be a risk. It would be helpful to understand how much of this is post-pandemic over-earning (hotels price gouging — not clear how sustainable that is) versus the management business growing high-quality revenue.

Valuation:

2023 operating income + depreciation: $100.5mm

Due to the risks discussed above, I don’t feel comfortable baking in any upside here for the base case.

In the bear case, I’ll price in a 15% probability of 2022’s results: $74.6mm

In the bull case, I’ll price in a 15% probability of return to 2019’s results: $142.7mm

Sustaining capex: $50mm

Part of my intrigue is that historical capex may have been abnormally high due to the industry-wide push towards “premium” theater seats being in the rear-view mirror. There’s probably some truth in that, but it’s difficult to ascertain to what extent.

Hotels are notoriously expensive to renovate and management has recently indicated that two major renovations are near completion, yet capex was only $38.8mm in 2023 vs depreciation of $67.3mm. Management has guided toward $20-$25mm in theater capex and $40-$50mm in hotel capex this year, but my read is that a large part of that is growth-oriented. $50mm seems reasonable to me.

$169.8mm long term debt + $17.7mm net AP + $92.2mm accrued expenses + $32.2mm deferred taxes + $80.7mm other non-current expenses - $34.3mm negative pension liability - $65.2mm cash (incl. $4.2mm restricted cash) = $293.1mm net liabilities

$100mm convertible notes at $11.01 conversion price — apparently they entered in some sort of capped call transaction that mitigates dilution by 2.8mm shares — but let’s just assume we take the full brunt of the dilution and wipe out the debt —> $193.1mm net liabilities

41.0mm fully diluted shares

So, we’re working with ~$50.5mm - 20% income tax = $40.4mm sustainable free cash flow in the base case: a 15x multiple (which I think is reasonable with a lot of the liabilities not bearing interest and full dilution) would get us to $10.07

In the bear case, equity is nearly worthless but that seems kind of harsh: let’s be kind and use a $5 valuation

In the bull case, with an 18x multiple I get to $27.85

Weighted Avg: $11.98

Sensitivity check: At $40mm sustaining capex, $13.35 in base case, $5 judgment call again in bear case, and $31.36 in bull case gets us to $14.79

As we can see, there is a bull case here but it’s highly-dependent on confidence in the box office recovering to pre-pandemic levels. Some of my assumptions here may be on the conservative side, but it also looks like 2024 theater performance is more likely than not to be materially worse than 2023. There just doesn’t seem to be a large mispricing in this stock.

What did I miss here before doing a more thorough write-up?

I underestimated the non-debt liabilities

I brushed off the convertible dilution (and to be fair, I’ve overestimated it here)

I wasn’t aware that box office ticket sales had been in a clear downtrend since 2002 — a clear secular decline

Some back of the envelope math on historical numbers made it look like this could be a free cash flow beast in a “return to normal” scenario. I thought I was being clever by looking here instead of another pandemic epicenter sector like cruise, but alarming long-standing trends and a hairy balance sheet are likely to turn me away.