Budget Macro Update #2

Dear Reader,

It’s been almost a year and a half since the first BMU. At the time, I was thinking that the economy would cool off in line with the fiscal impulse. Honestly, I’m not really sure how to even characterize whether that was wrong or not given how weird everything has been. We did see services inflation cool down, for instance, but I’ll give the economy the benefit of the doubt: I underestimated it.

As a reminder, the whole point of this is for us to to take a lot at the data with our own sets of eyes. Just about everyone has macro views, but very few people actually look at the data. Well then, shall we?

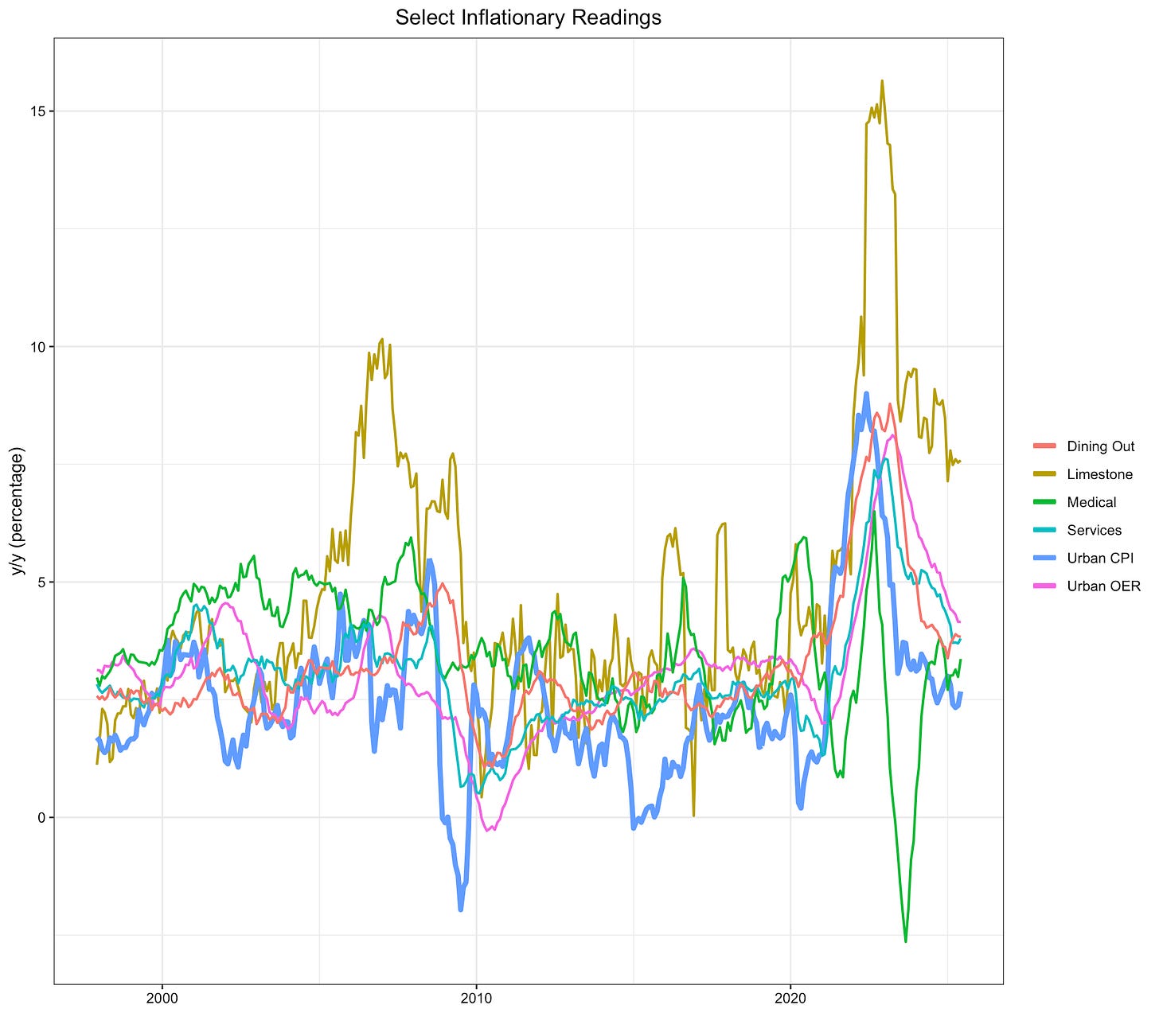

Select Inflationary Readings:

Crushed rocks remain king. Services and rent have cooled off fairly steadily, but recently services inflation is stuck well above the 2% target. Meanwhile, dining out has actually re-accelerated. In June’s data:

Haircuts were up 3.8% y/y

Medical care services were up 3.8% y/y

At home (medical) care were up 4.2% y/y

Laundry/dry cleaning services were up 4.9% y/y

Nursing homes were up 5.1% y/y

Motor vehicle repair/maintenance was up 5.2% y/y

Trash collection services were up 5.4% y/y

Pet services / vet were up 5.6% y/y

Yeah, how about that? You feeling like inflation is under control?

Back in the olden days, the Fed used to talk about something called a wage-price-spiral, but they don’t talk about that anymore because it’s inconvenient.

Regional Inflation:

It’s interesting to see the Northeast running 75 bps hotter than the South

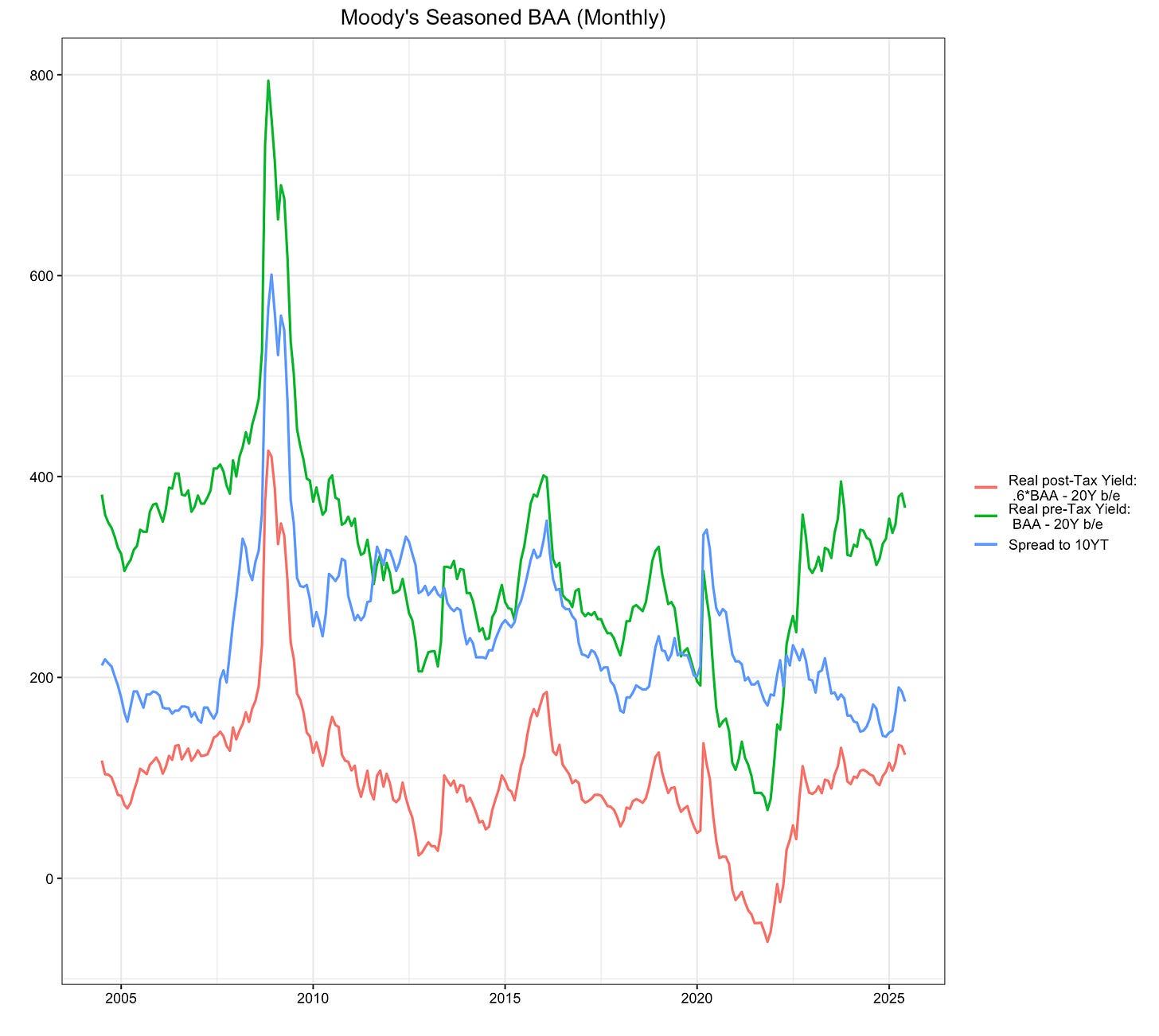

Moody’s BAA:

Spread to treasuries remains tight — the increase in the blue line at the end is just a duration mismatch as the yield curve steepens: As fascism intensifies, the lines between government and corporate credit risk blur. Meanwhile, compensation relative to inflation breakeven is testing a breakout. My read here is that risk from some potential AI losers (or other megatrends) are being priced in. Tough to interpret what’s going on here, but broadly speaking I think it’s fair to say bond investors are feeling antsier.

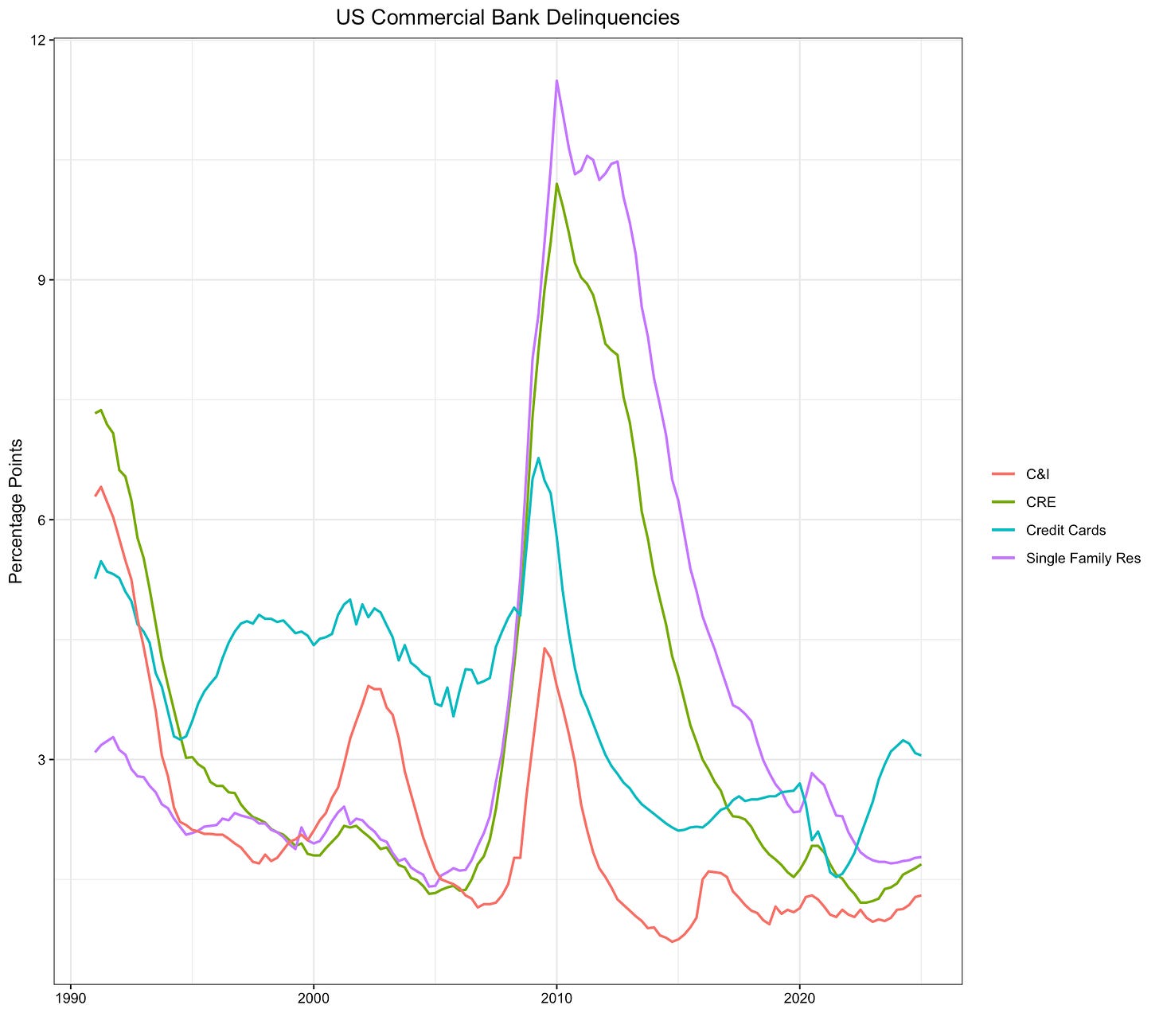

Commercial DQs:

Credit cards ended up mellowing out, while it appears real estate and C&I may have troughed.

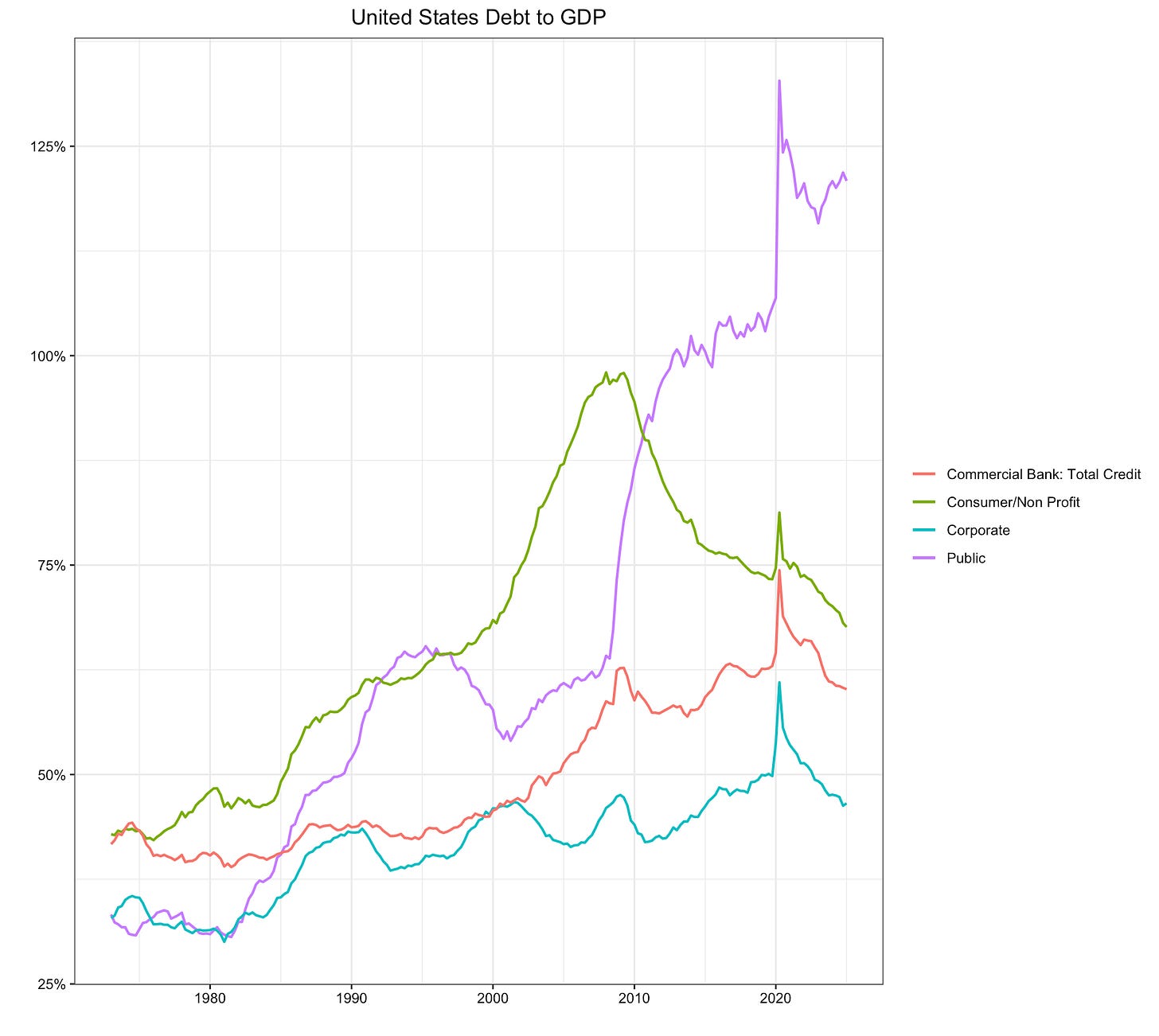

Debt:

Hey, check it out! The government bailed out…everybody. No wonder the economy is so strong.

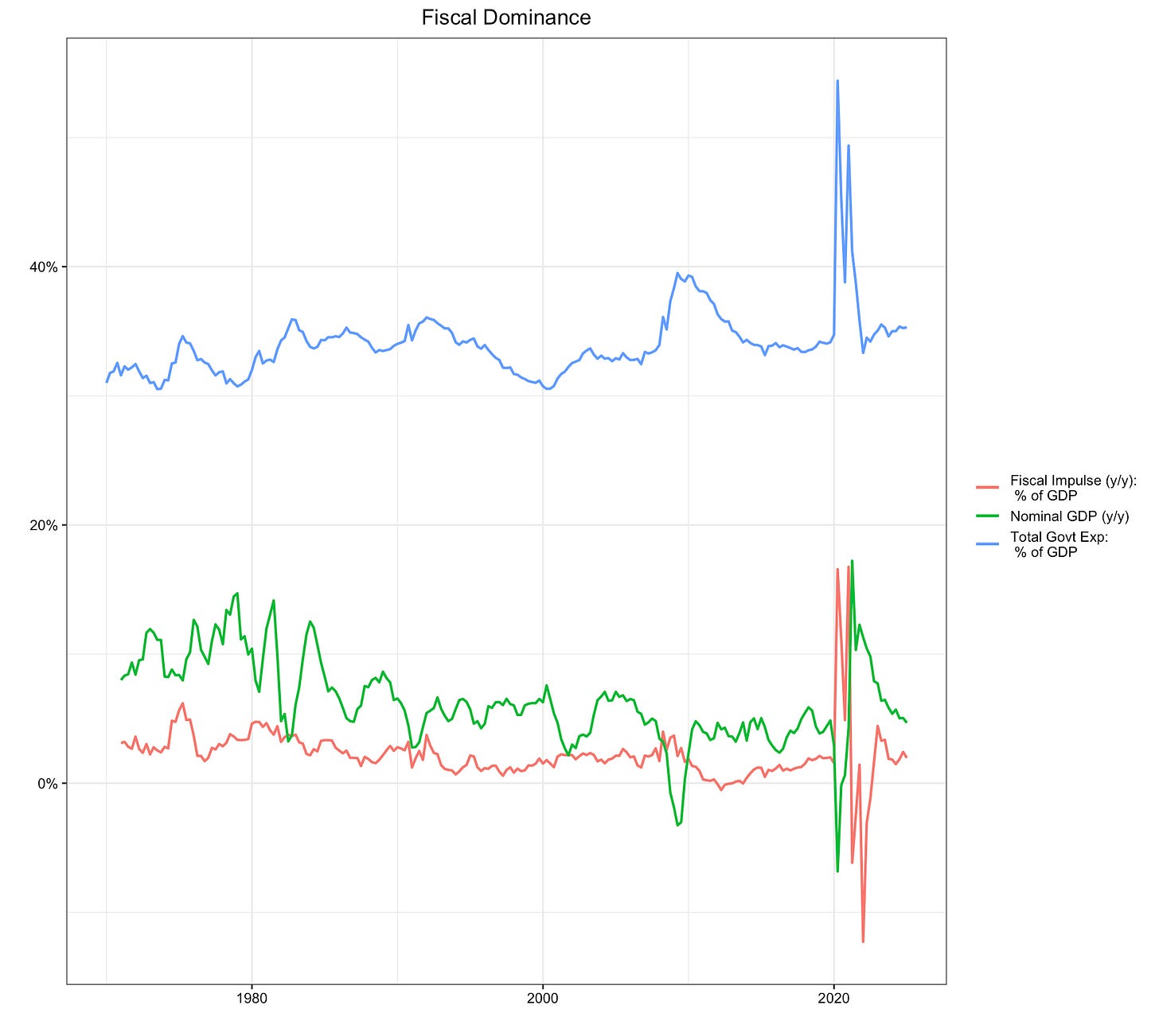

Fiscal:

Interestingly, we did see the fiscal impulse re-accelerate — it was brief, and slight, but it does somewhat validate my framework from last year’s BMU as nominal GDP continues to decelerate despite even the re-acceleration in commercial bank credit (the other major piece of the puzzle here):

My gut feeling is that the banks will set the tone for the next few quarters, assuming there’s no major fiscal impulse coming. If they can keep up strong credit growth, they can prop up the economy for a while longer. Otherwise, I think we are in the “crashing from sugar high” phase of fiscal dominance within a broader slowdown trend.

thanks for sharing ur thoughts on this